ERPNext is ZATCA e-invoicing compliant

Our customers and partners are heaving a sigh of relief, as KSA approves of e-invoicing that was long due. This will make the invoicing lifecycle journey seamless.

For a brief period, our users and partners from the KSA region have had a tough time processing the e-invoicing. Due to manual and paperwork, their projects faced several hindrances. Now that Saudi province has made e-invoicing a mandate, it will be easier for them to deal with transactions and thus the operations will be streamlined.

Muhammad Ahmad from Havenir solutions played a major role in developing the solution and giving life to the whole e-invoicing process. On the other hand, Mohammed Redha, Co-founder of Accurate Systems is an active contributor to the ERPNext community for 10+ years. Since his organization is based out of KSA, they chose to offer us some help by incorporating the e-invoicing and getting it approved by ZATCA (Zakat, Tax and Customs Authority). Frappe is grateful to the team of Accurate Systems and appreciates their help.

Let us understand what is e-invoicing and its requirements.

What is e-invoicing?

E-invoicing is the process of generating invoices in a digital format, so you can issue and store them electronically. The Zakat, Tax and Customs Authority in the Kingdom of Saudi Arabia (KSA) has rolled out regulations mandating businesses to adopt an e-invoicing process in two phases, starting on December 4, 2021.

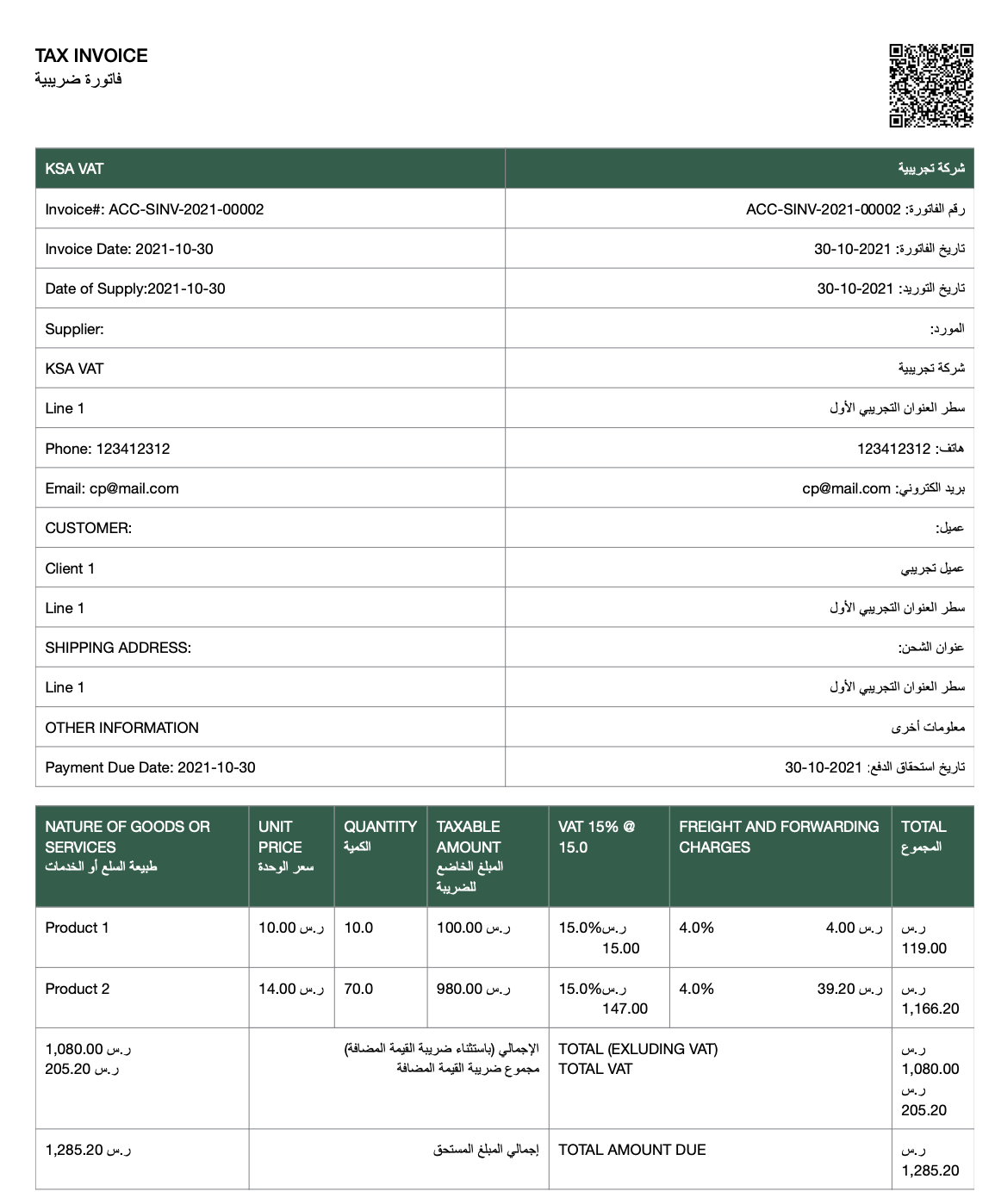

(E-invoice)

Who is subject to the e-invoicing regulations?

Taxable people resident in Saudi Arabia will have to issue and store e-invoices in electronic format with predefined data fields. The requirements also apply to third parties who are issuing tax invoices on behalf of resident taxable people. The e-invoicing rules will not apply to taxable people who are not resident in Saudi Arabia.

What are the technical requirements of an e-invoice?

The e-invoicing regulations contain preliminary requirements for the technology that enables issuance and storing of e-invoices, including:

- The ability to connect with external systems using the Application Programming Interface (API)

- Compatibility with all the requirements and controls applied in Saudi Arabia about data or information security or cybersecurity

- The solution must be tamper-proof and should include a mechanism that allows detection of any data intervention or manipulation

- The ability to connect with the Internet

What does an e-invoice look like and how is it different from current invoices?

For Phase 1, the format of the e-invoices is similar to that of current tax invoices, with some additional fields. For simplified tax invoices (issued for B2C transactions) it is mandatory to add QR codes, VAT number of the buyer if the buyer is a VAT registered payer, and optional to add QR code. No specific file format has been specified for Phase 1, but they must be issued from an electronic system meeting ZATCA's requirements. Also, electronic copies of all invoices must be stored by the taxpayer.

E-invoicing at ERPNext

Early this month, Harshit from the Product Team organized a webinar on e-invoicing where Redha gave a demo. This was helpful for people operating in the KSA region. You can find the recording of the demo on YouTube below:

To further understand the procedure of e-invoicing and report generation in ERPNext, please refer to this user manual.

dear how can i apply ksa zadca e invoice in erpnext frappe production using VM ubuntu ?!!

thank you very much